The open database for university spinouts

Help us empower university inventors to form spinouts from their research.

Spinout.fyi V1 database release

Published by Nathan Benaich on 13 June 2022.

In May 2021, I wrote an essay and an FT oped to catalyse a discussion on rewriting the university spinout playbook. In the last year, we crowdsourced deal terms from spinouts all over the world.

And today, we’re sharing the Spinout.fyi database: The largest of its kind.

By publishing the raw survey data in the open, we want to level the information playing field for spinout founders who too often enter negotiations with their university Tech Transfer Offices not knowing what to expect. In this blog post, we'll share our key findings, data, and founder quotes to add color. You can also download these slides here.

About the data

The database includes 143 unique entries from 71 universities from around the world.

- 47% of the universities are based in the UK, 37% in Europe, and 11% in the US.

- 41% of the spinouts raised Seeds, 17% raised Series As, 2% raised Series Bs, 15% were pre-funding, 3% no longer exist, 3% IPO'd, 7% exited via M&A.

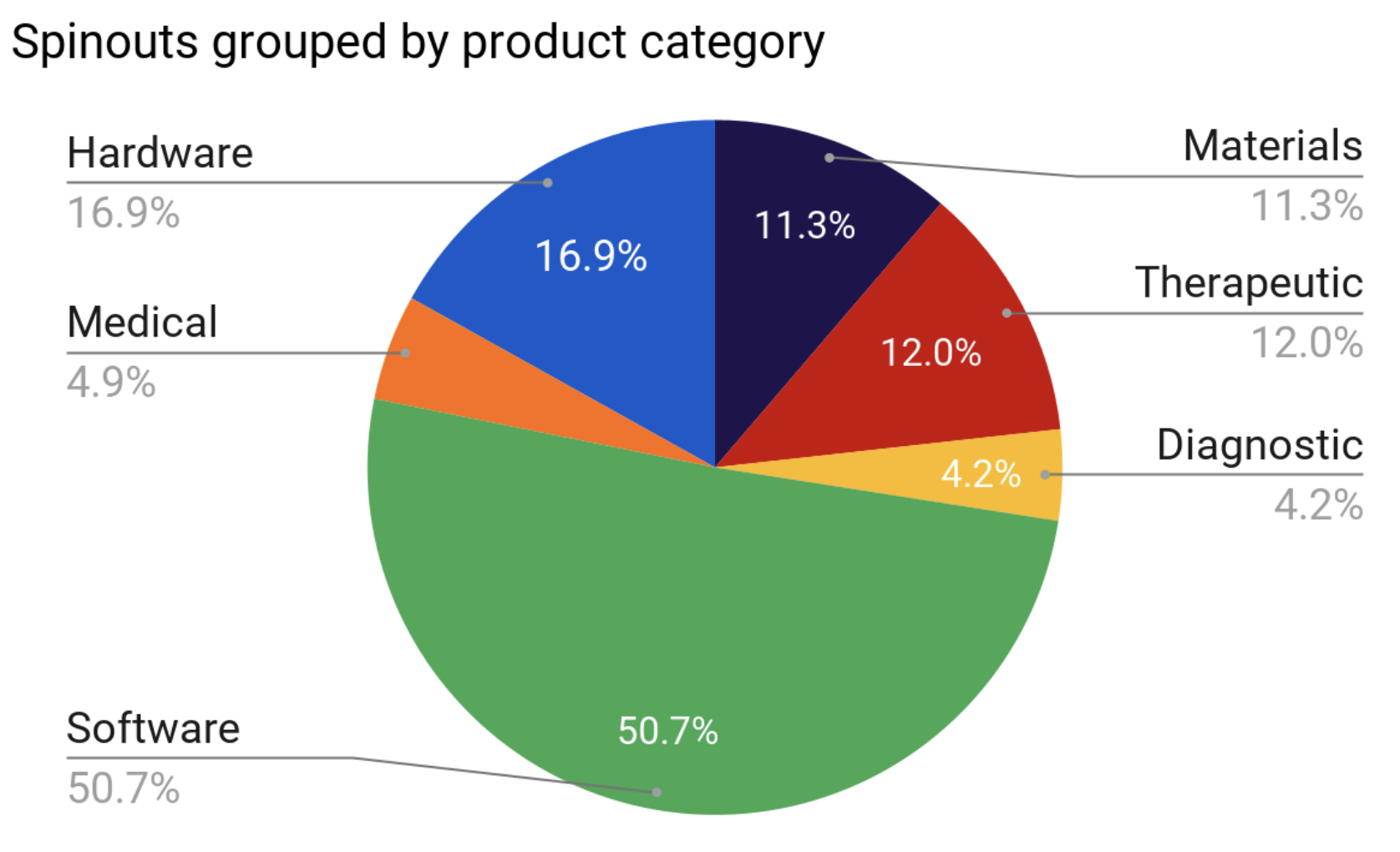

The spinouts in the database cover a wide range of products, which we summarised into 6 categories: Software, Hardware, Therapeutics, Materials, Medical, and Diagnostics. The breakdown is depicted below:

Most founders are dissatisfied, and time is to blame

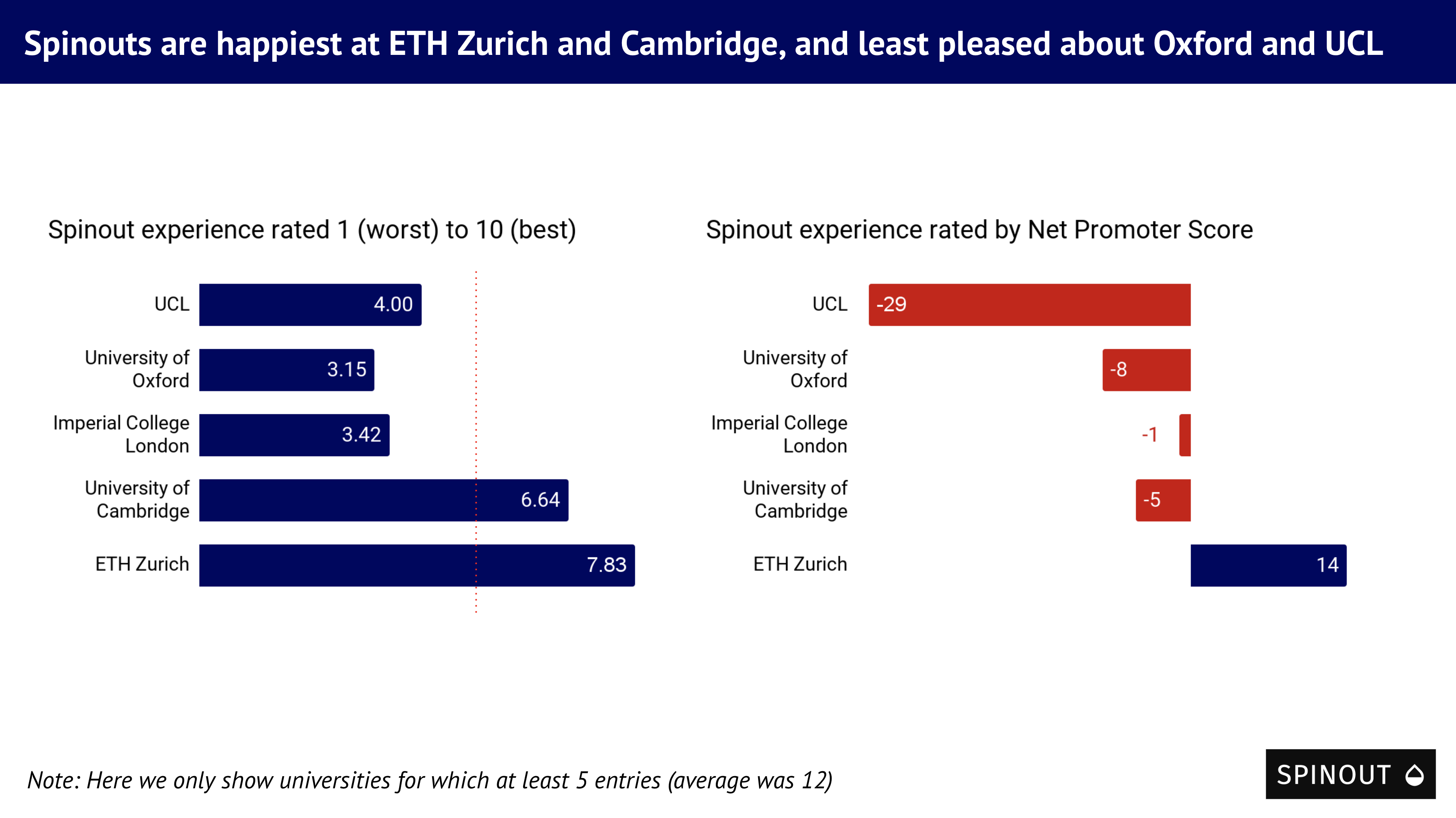

Founders have virtually nowhere to share their spinout experience. So in addition to data on spinout deal terms, we wanted to understand founders’ sentiment on the spinout process. In short, founders are clearly not happy with their experience. Overall, they rated it 4.6 out of 10 or an NPS of -56 (!). Seen as a product, the process is very far from Product Market Fit.

Here are some quotes that add more color around the bad/neutral/good experiences in the dataset:

Imperial College London: Experience was very bad overall.

University of Cambridge: Experience largely good, although the university shareholder agreement has substantially more onerous terms [...] than one might see elsewhere.

Uppsala University: In Sweden, researchers own the IP they produce. Therefore, spinout terms are excellent.

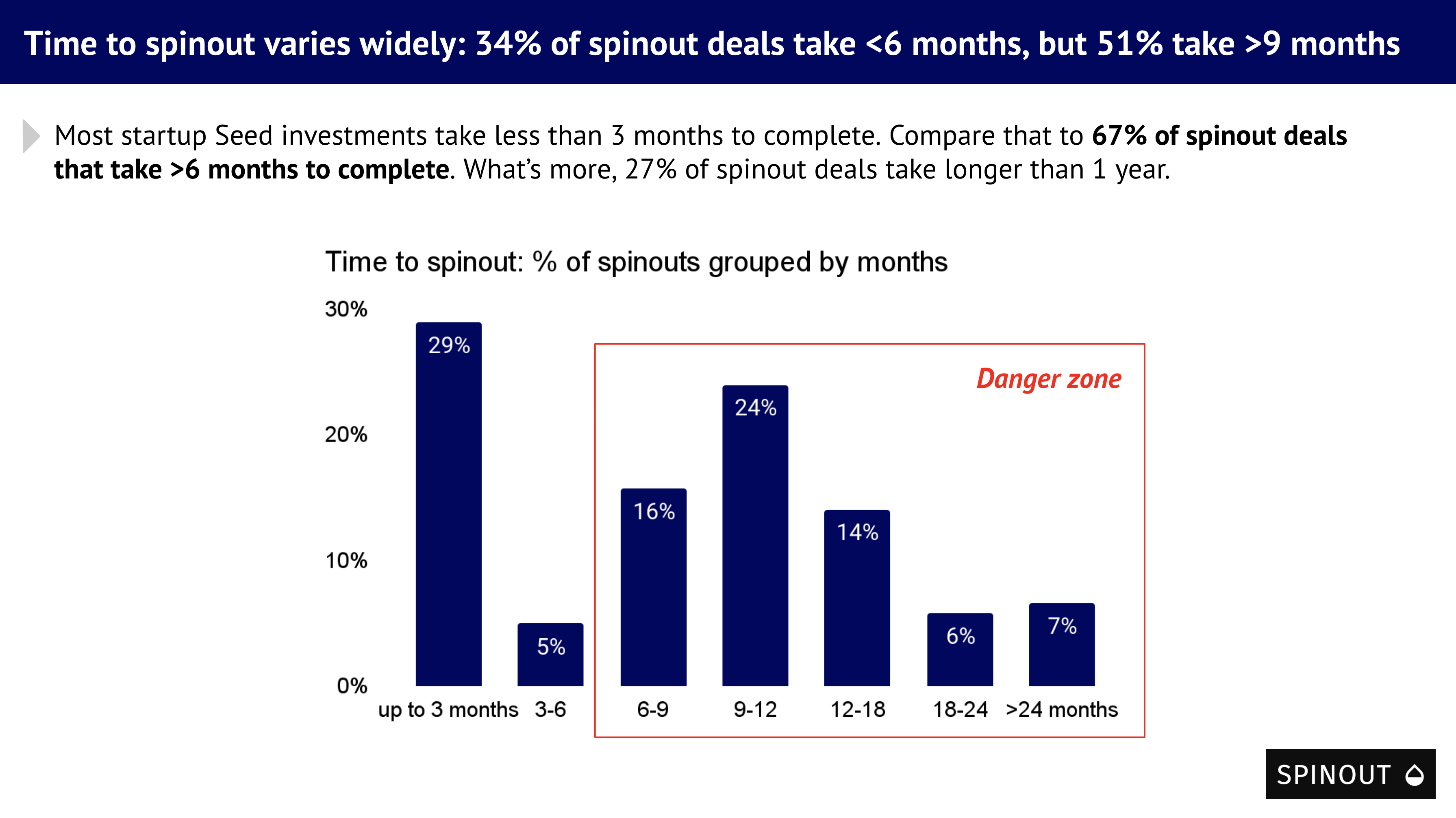

So why are spinout founders so unhappy? The main factor is Time to spinout. The negotiation process is too long and cumbersome: 66% of spinout deals take longer than 6 months to complete, and 27% more than a year.

In comparison, startup seed rounds typically take 3 months.

Some founders indeed complained that the long spinout process leads to loss of financing and business opportunities:

University College London: The most painful part of the whole process was how long it took. Angels wouldn't invest until we'd finalised the spinout process. And that took 9 months. It parallelised us.

TU Delft: The process took well over a year, leading to loss of initially interested industry partnerships.

UCLouvain: Difficult and long negotiation process to manage in parallel to R&D and business.

Harvard University: Everyone was happy in the end, but it took sooooo long to get there - the speed of decision-making was the biggest bottleneck for us.

Equity and royalties... why so high?

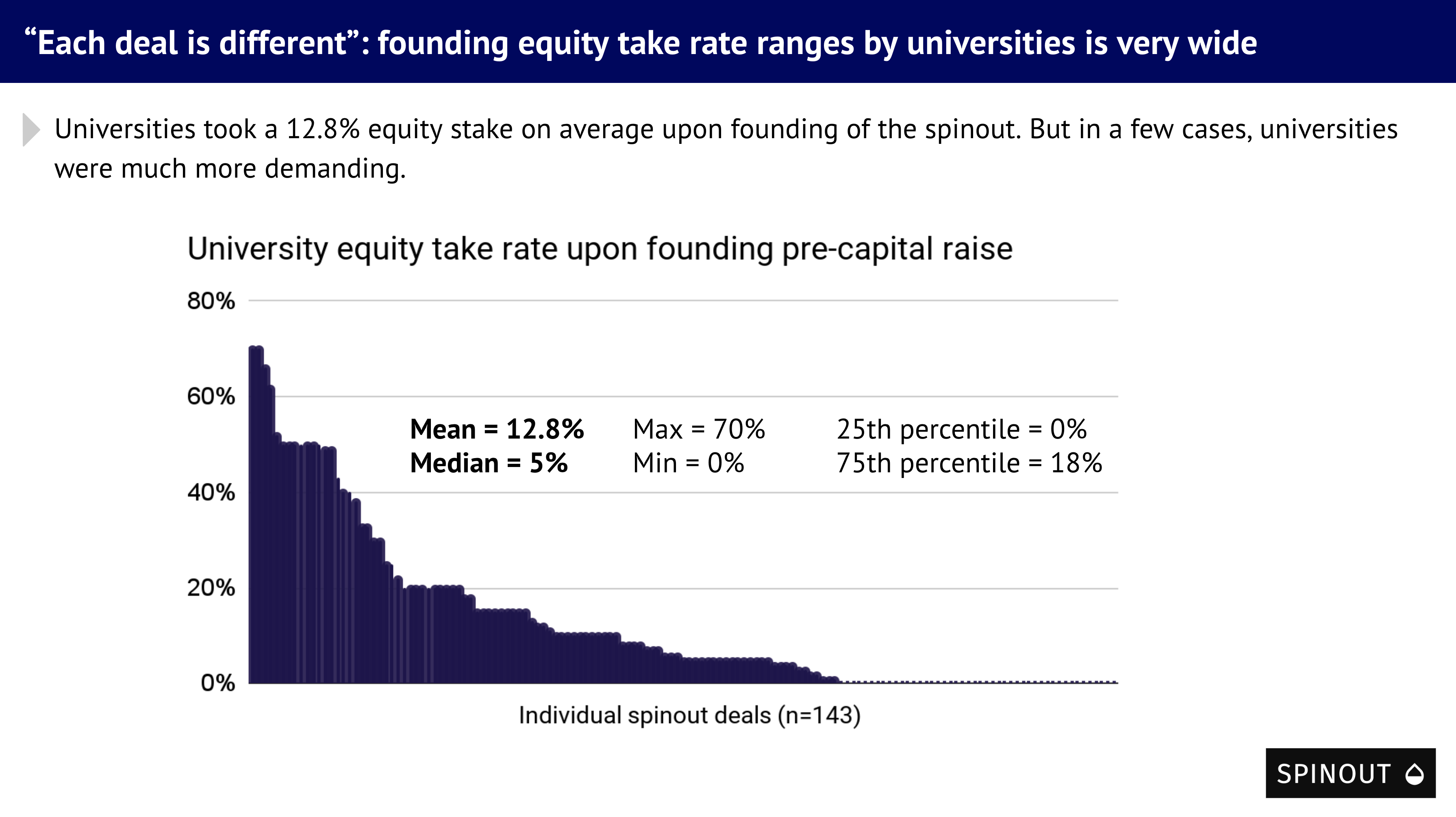

Equity: For spinouts, each deal is different. On average across all locations, universities took a 12.8% equity stake in spinouts. But the founding equity take ranges by universities is very wide, from 0% to 70%.

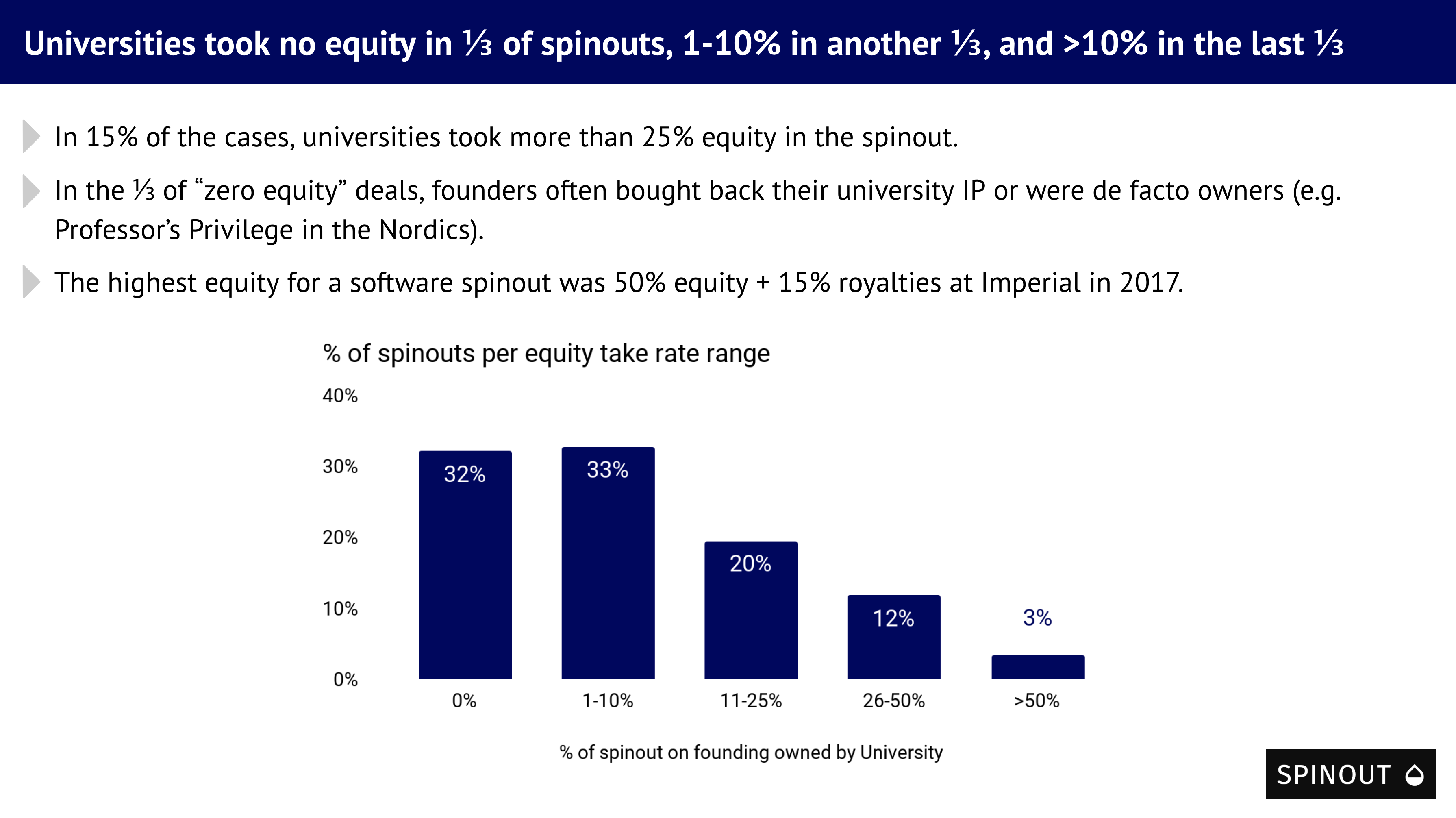

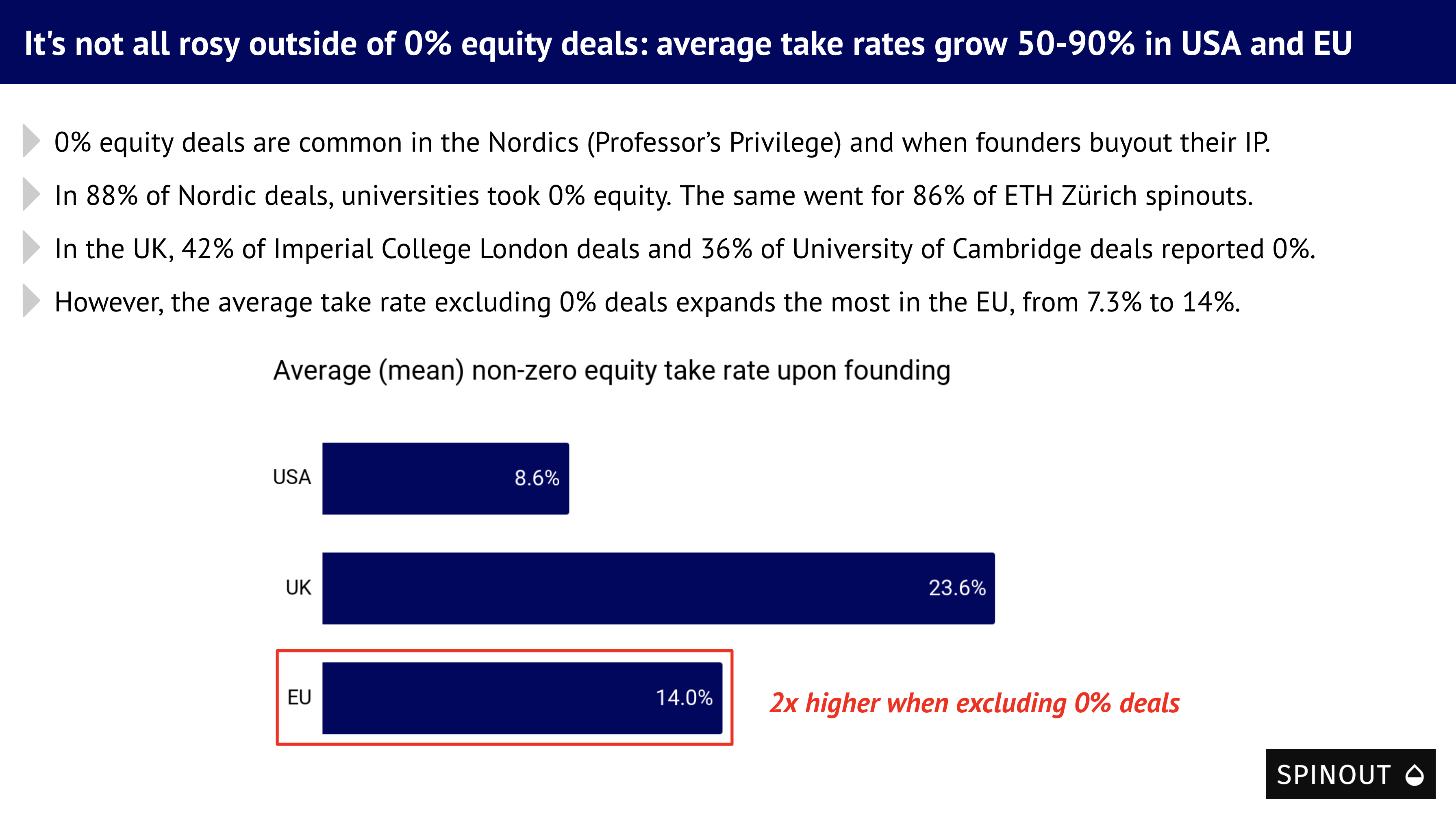

There is little predictability or standards across universities: ⅓ took no equity, ⅓ took 1-10%, and ⅓ took >10%. Note that the "zero equity" deals are common in the Nordics thanks to Professor's Privilege rules — a researcher de facto owns the rights to their research, or when founders buy their IP outright.

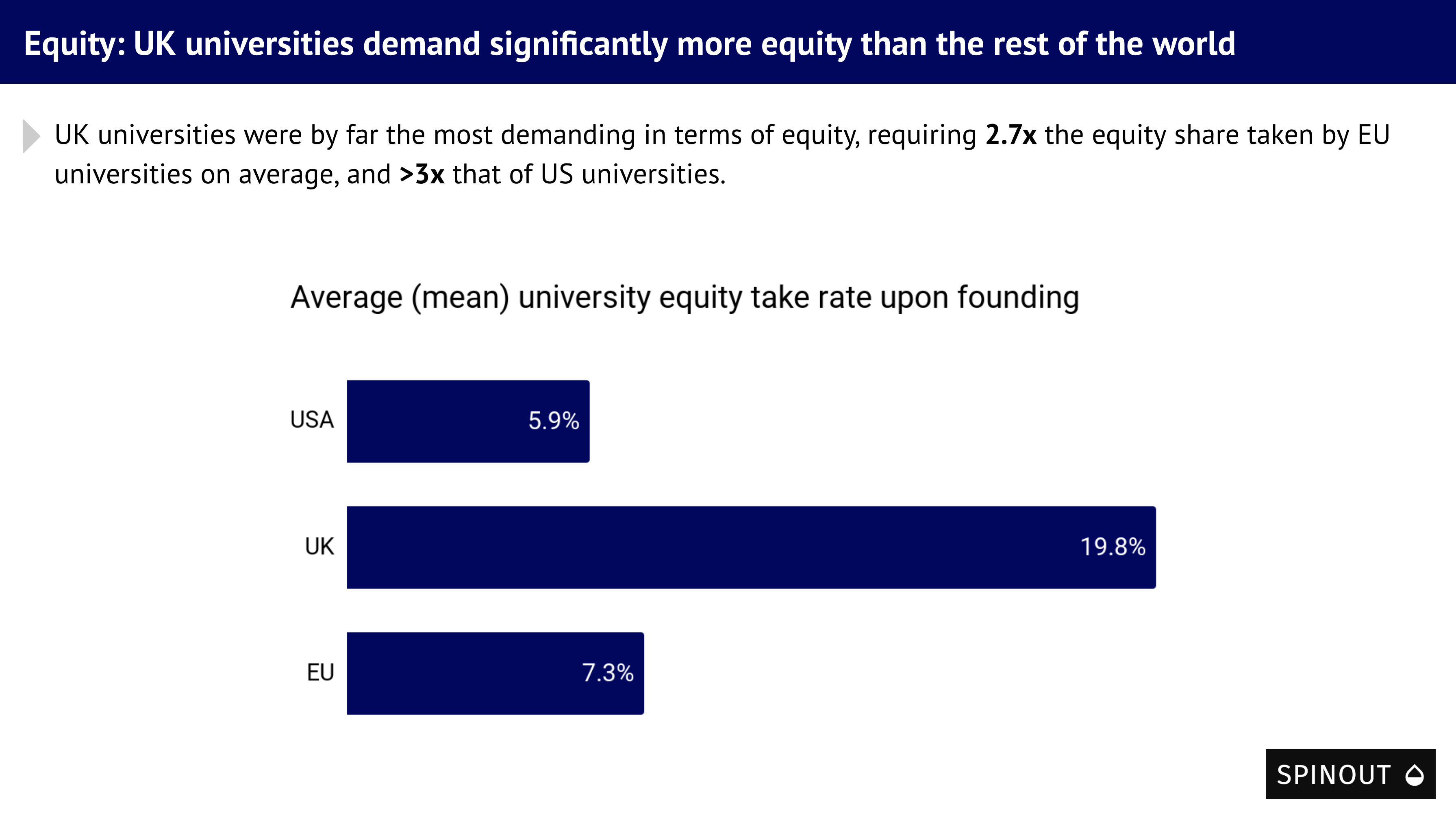

Diving deeper into the geographic nuances, we found important trends: UK universities (19.8%) required 2.7x more equity taken by European universities (7.3%) on average and >3x that of US universities (5.9%).

Here are some more quotes that illustrate the issues that founders see on equity take rates:

University of Nottingham: UK Universities need to overhaul the spin-out process. 50% was only a recent development for Nottingham, who insisted on 60% in 2019 and previously.

University of Oxford: Egregious pre-money equity expectations. Intransigent and complete rejection of IP assignment (despite agreed-begrudgingly, 49% pre-money equity stake) which led to a failure of the funding round.

University of Warwick: Thought deal was okay. If doing again wouldn't spin out, just pay up front to license and bully uni to take our terms. Licensed tech won't be worth much in 5 years, but the equity we have away will.

European universities may come out as a haven for spinout founders. But in fact, European universities' average equity stake upon spinout founding is held down by a few founder-friendly universities like ETH Zürich and Professor’s Privilege rules in the Nordics. For example, in 88% of deals from the Nordics, universities took 0%. The average take rate excluding 0% deals expands the most in Europe, from 7.3% to 14%.

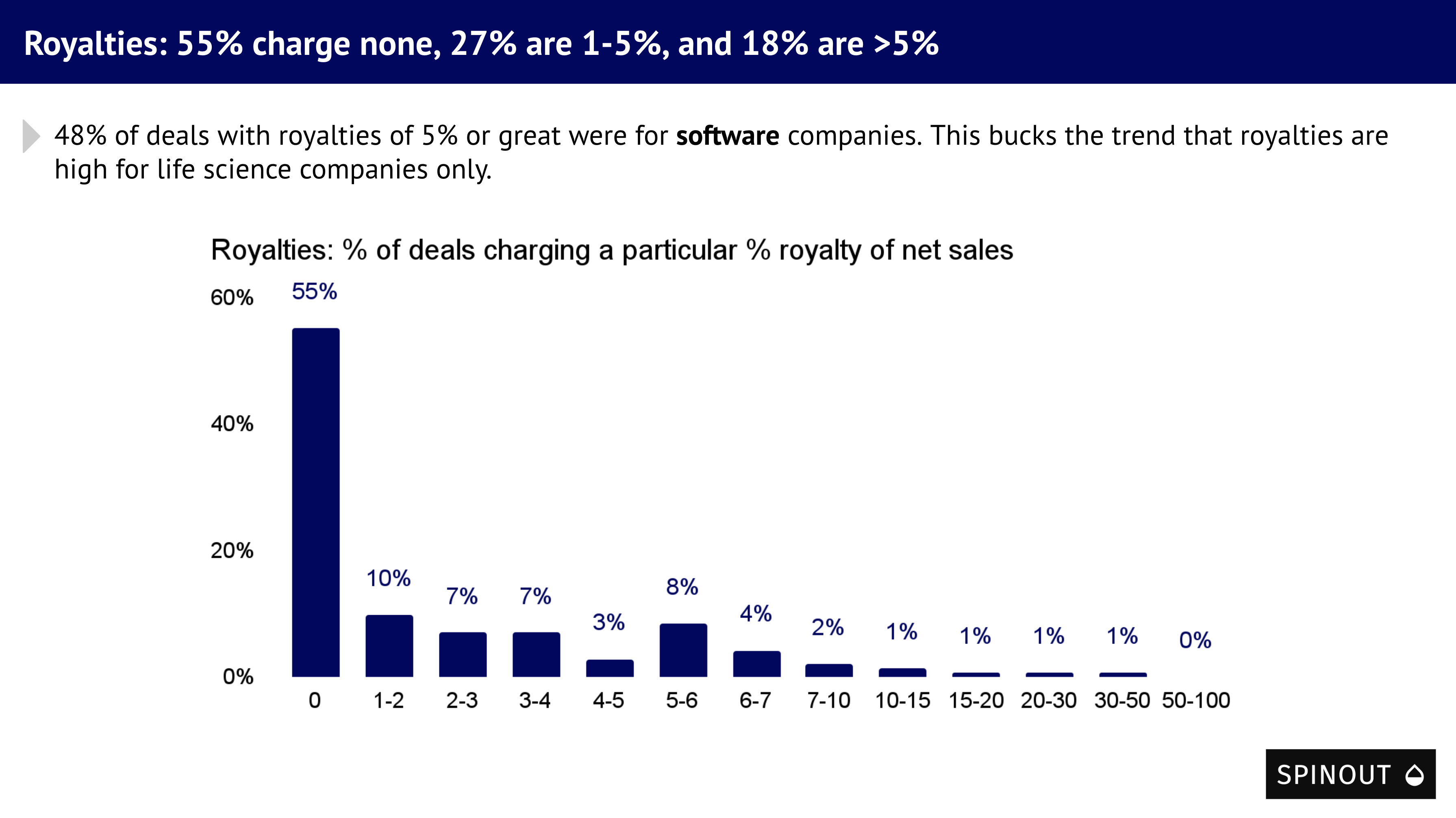

Royalties: Another term founders need to negotiate with TTOs is royalties. Royalties on net sales are levied in 46% of cases. Contrary to what is usually assumed, royalties don't spare software companies. In fact, 48% of deals with royalties of 5% or greater were for software companies.

Many founders found that royalties as a percentage of net sales were a drag on their company.

University College London: Should be 0% equity/royalties

University of Strathclyde: 20% non-negotiable equity and an additional royalty is a killer.

Are the terms levied by TTOs on spinouts justified? To answer this question, we asked two questions.

- First: Was your spinout clearly founded on IP that you developed at the University? The answer was Yes in 77% of the cases.

- Second: Does your spinout still depend on its original IP today? The answer was No in 32% of the cases.

Beyond the data: an opaque and bureaucratic process

All the data in the world can't capture the founder's overall experience. Many respondents said that the spinout process was opaque and bureaucratic, that it was handled by unprofessional or untrained teams, or even that founders were treated as “naughty kids”. Here are some examples:

Loughborough University: Generally I’ve found the spin out process opaque, frustrating and a TTO that’s not been supportive or enthusiastic. [...] we have found ourselves being treated as naughty kids”

University College London: [University] creates undue delays and inflexibility, extending University style bureaucracy which is incompatible with the startup context.

Fraunhofer EMI: Slow process with many parties, not well coordinated, lot's of (unnecessary) pressure building, highly unprofessional argumentation.

But it’s not all doom and gloom: among universities which had at least 5 entries, spinouts are happiest at ETH Zürich and Cambridge, and least pleased about Oxford.

Help us rewrite the spinout playbook

Founders often lack information to negotiate their spinout deals. They end up with unfair deal terms and an unnecessarily awful spinout experience.

Founders, help us give future founders a leg up in the process by submitting your anonymous deal terms at https://www.spinout.fyi.

To download the slides in this blog post, click here.